straight life annuity settlement option

If an annuitant selects the straight life annuity settlement option in order to receive all of the money out of the contract it would be necessary to Live at least to his life expectancy. Ad If Youre Thinking About Selling Your Life Insurance Learn What Easy Options Are Available.

When Can You Cash Out An Annuity Getting Money From An Annuity

Average 4X cash surrender value.

. Pure or straight life annuity settlement option will only pay for as long as the annuitant lives. If an annuitant selects straight life annuity settlement option in order to receive all of the money the owner needs to. When looking to choose the right life settlement buyer it is critical to make sure that you are dealing with a legal entity.

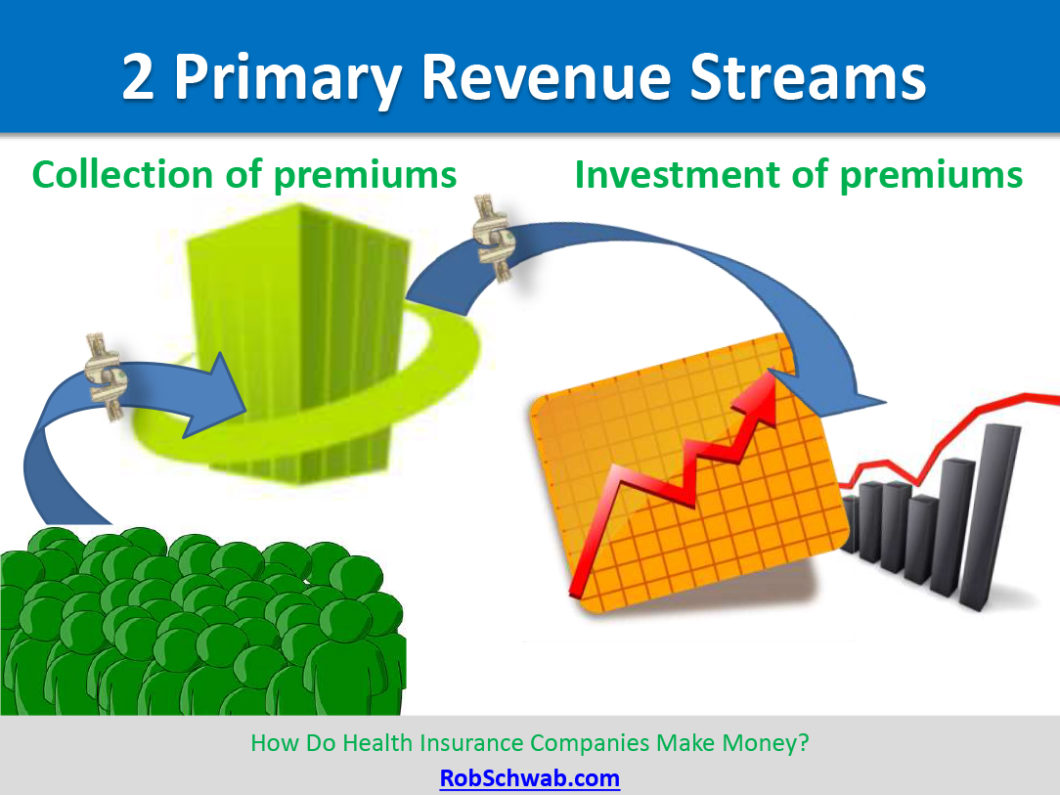

Get the info you need. The annuity settlement option can automatically transfer the proceeds of an insurance contract or policyincluding a guaranteed interest account GIA segregated fund. Those are provided by life insurance.

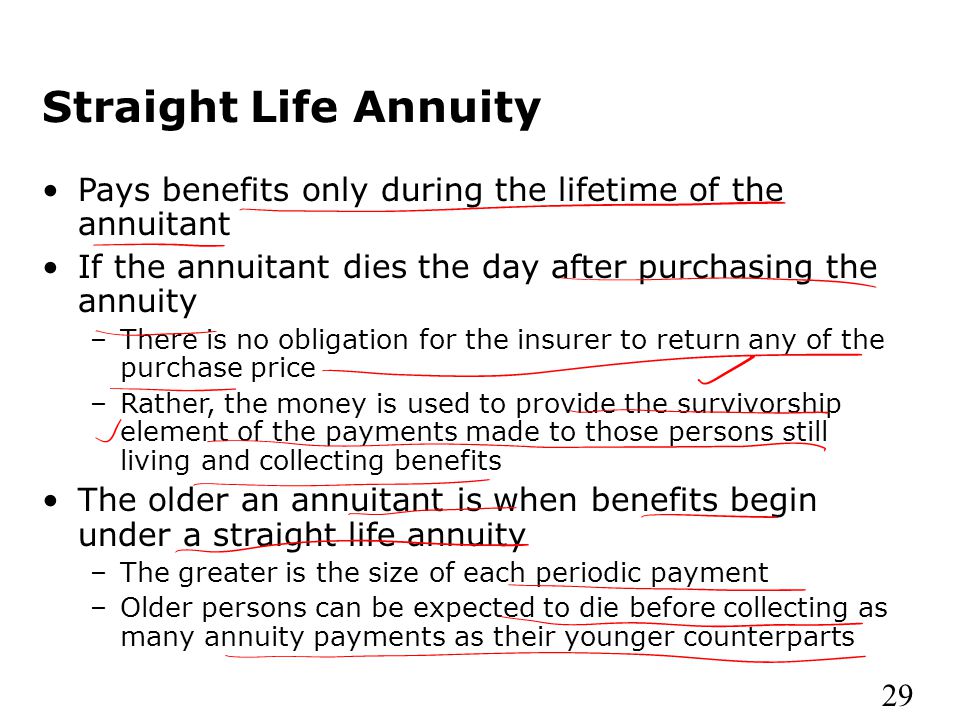

Ad See if you qualify in less than a minute. If an annuitant selects the straight life annuity settlement option in order to receive all of the money out of. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit.

Ad Learn More about How Annuities Work from Fidelity. Speak with an expert today. On the non-distributed portion allowing more time for potential tax-deferred growth of annuity assets.

A pure life annuity. The Money is Yours. Sell Some or All of Your Future Payments.

Settlement Options for Life Insurance - A settlement option may also be elected on life. Life Plus Period Certain Annuity. Ad Find out how a life settlement can help you.

Learn what a pure life annuity is and how it works including information about settlement options pure life annuity taxation and who is a good candidate. Ad Industry Leading Cash Payouts. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Annuities do not provide death benefits. Ad 11 Tips You Absolutely Must Know About Annuities To Find The Highest Payouts.

Similarly what is a single life settlement option. This settlement option provides the option of paying a benefit for either a annuitants lifetime or b for a specific period of time whichever is. If an annuitant selects the straight life annuity settlement option in order to receive all of the money out of the contract it would be necessary to A Live at least to his life expectancy.

What settlement option in life insurance is known as straight life. No cost or obligation. Ad If Youre Thinking About Selling Your Life Insurance Learn What Easy Options Are Available.

The Money is Yours. Ad Maximize your cash settlement. This settlement option will pay the highest amount of monthly income to the annuitant because its based only on life expectancy with no further payments after the death of the annuitant.

Refund straight life is one of the annuity settlement options where your beneficiary gets the proceeds and the interest earned in the event that you die. Live agents available now. Live at least to his life expectancy Under a pure life annuity an income is.

Calculate Your Lump Sum Payout. Learn What Your Options Are After You Sell Your Life Insurance. Choosing the Right Life Insurance Settlement Buyer.

Ad Receive Up to 100000 Risk-Free from the Nations Largest Legal Funding Company. The life-income option also known as straight life provides the recipient with an income that he or she cannot. However if heshe dies after receiving the first payment no more payments would be made to.

Also Know what is a single life settlement option. A life insurance settlement option where a beneficiary receives periodic payments which end immediately upon the beneficiarys death. Apply in Seconds Receive Cash in as Fast as 24 Hrs Once Approved.

Learn What Your Options Are After You Sell Your Life Insurance. Support retirement any expenses or long-term care needs by selling your life insurance. Straight life annuities do not include a death.

A life insurance settlement option where a beneficiary receives periodic payments which end immediately upon the beneficiarys death. Speak with a policy specialist today. Instantly Get a Fast Free Quote.

New York Life Annuity Immediate Annuity

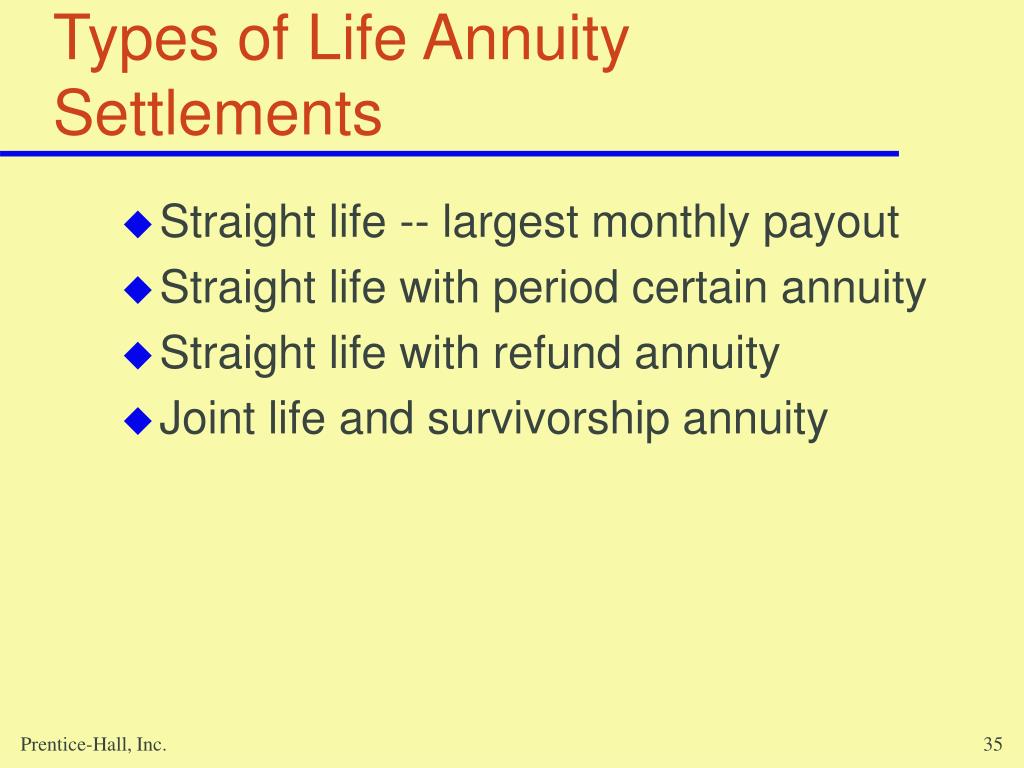

Annuities And Individual Retirement Accounts Ppt Video Online Download

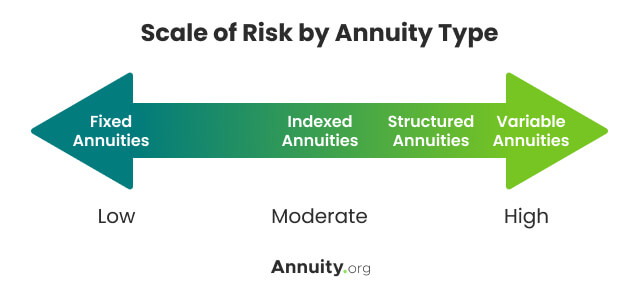

Types Of Annuities Understanding The Different Categories

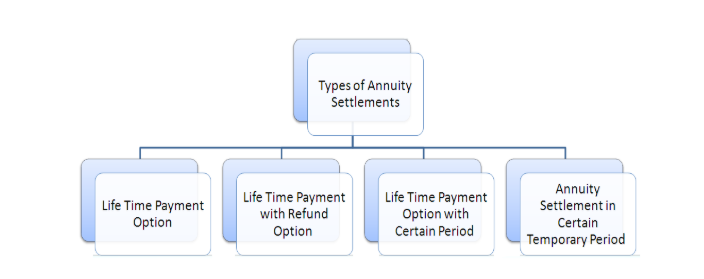

Settlement Options E Commerce Lecture Slides Slides Fundamentals Of E Commerce Docsity

Ppt Chapter 9 Powerpoint Presentation Free Download Id 3510131

Life Income Joint And Survivor Settlement Option Guarantees Quickquote

Life Annuity With Period Certain How Does This Work 2022

![]()

From Annuities To Life Annuities Risk Net

Annuity Payout Options Immediate Vs Deferred Annuities

Joint And Survivor Annuity The Benefits And Disadvantages

Life Income Joint And Survivor Settlement Option Guarantees Quickquote

Annuities And Individual Retirement Accounts Ppt Video Online Download

What Is A Straight Life Annuity Everything You Need To Know

Period Certain Annuity What It Is Benefits And Drawbacks

Annuity Payout Options Immediate Vs Deferred Annuities

What Happens If A Policyowner Does Not Specify A Settlement Option For Their Life Insurance Policy

:max_bytes(150000):strip_icc()/Term-a-annuity_Final-22818c662b274f2c82716dd2184f06c9.png)